Delta Apparel designs, manufactures, and markets activewear and lifestyle products. The company offers digitally-printed apparel under the DTG2GO brand; silhouettes and fleece products; as well as polos, outerwear, and bags and accessories. In addition, Delta Apparel offers swimwear, sunglasses and related apparel under the Salt Life brand. DLA distributes its products to sporting goods and outdoor retailers, specialty and resort shops, department stores, and online.

The Zacks Rundown

DLA has been severely underperforming the market over the past year. A Zacks Rank #5 (Strong Sell) stock, DLA experienced a climax top in May of last year and has been in a price downtrend ever since. The stock is hitting a series of 52-week lows and represents a compelling short opportunity as the market continues to hover in a deep correction.

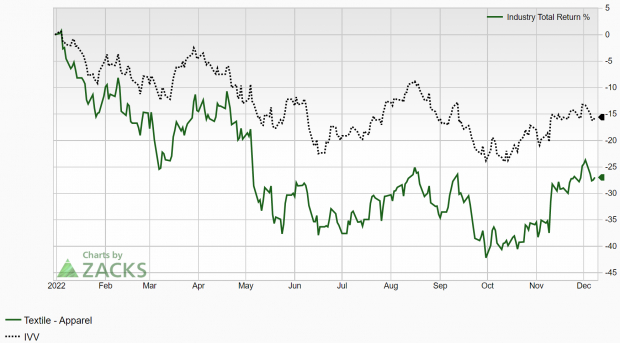

Delta Apparel is part of the Zacks Textile - Apparel industry group, which currently ranks in the bottom 28% out of approximately 250 industries. Because this industry is ranked in the bottom half of all Zacks Ranked Industries, we expect it to underperform the market over the next 3 to 6 months. Candidates in the bottom half of industry groups can often represent solid potential short candidates.

While individual stocks have the ability to outperform even when included in poor-performing industries, their industry association serves as a headwind for any potential rallies. Note how this industry has underperformed the market this year at nearly every turn:

Image Source: Zacks Investment Research

Weak Foundation: Falling Short on Earnings and Deteriorating Forecasts

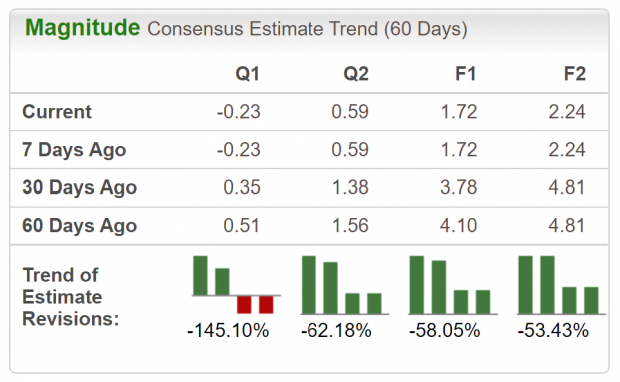

Earnings misses have been a sore spot for DLA during the past year. The apparel designer has fallen short of estimates in two of the past four quarters. DLA most recently reported a fiscal Q4 loss last month of -$0.04/share, missing the $0.61 consensus estimate by -106.56%. Revenues of $115.5 million also missed estimates. Last year, the company reported earnings in the fourth quarter of $0.96/share. This is the type of negative trend that the bears like to see. Consistently missing estimates by a wide margin is a recipe for stock price underperformance.

Analysts are bearish on the stock and have been revising earnings estimates downward as of late. For the current quarter, estimates have been slashed -145.1% over the past 60 days. The Q1 Zacks Consensus EPS Estimate now stands at $-0.23/share, translating to a -145.1% earnings regression relative to the same quarter last year.

For the current fiscal year, analysts have also reduced their EPS estimate by -58.05% in the past 60 days. The 2023 Zacks Consensus EPS Estimate is now $1.72/share, reflecting a -38.57% decline compared to last year.

Image Source: Zacks Investment Research

Technical Outlook

As illustrated below, DLA is in a sustained downtrend. Notice how the stock has plunged below both the 50-day and 200-day moving averages signaled by the blue and red lines, respectively. The stock is making a series of lower lows, with no respite from the selling in sight. Also note how both moving averages have rolled over and are sloping down – another good sign for the bears.

Image Source: StockCharts

While not the most accurate indicator, DLA has also experienced what is known as a ‘death cross’, wherein the stock’s 50-day moving average crosses below its 200-day moving average. DLA would have to make a serious move to the upside and show increasing earnings estimate revisions to warrant taking any long positions in the stock. The stock has fallen nearly 60% this year alone.

Final Thoughts

A deteriorating fundamental and technical backdrop show that this stock is a laggard. The fact that DLA is included in one of the worst-performing industry groups is simply another headwind in a long list of concerns. A history of earnings misses and falling future earnings estimates will likely serve as a ceiling to any potential rallies, nurturing the stock’s downtrend.

DLA’s characteristics have resulted in a Zacks Growth Style Score of ‘C’, indicating its prospects are dwindling. Potential investors may want to give this stock the cold shoulder, or perhaps include it as part of a short or hedge strategy. Bulls will want to steer clear until the situation shows major signs of improvement.

Bear of the Day: Delta Apparel, Inc. (DLA)

Delta Apparel designs, manufactures, and markets activewear and lifestyle products. The company offers digitally-printed apparel under the DTG2GO brand; silhouettes and fleece products; as well as polos, outerwear, and bags and accessories. In addition, Delta Apparel offers swimwear, sunglasses and related apparel under the Salt Life brand. DLA distributes its products to sporting goods and outdoor retailers, specialty and resort shops, department stores, and online.

The Zacks Rundown

DLA has been severely underperforming the market over the past year. A Zacks Rank #5 (Strong Sell) stock, DLA experienced a climax top in May of last year and has been in a price downtrend ever since. The stock is hitting a series of 52-week lows and represents a compelling short opportunity as the market continues to hover in a deep correction.

Delta Apparel is part of the Zacks Textile - Apparel industry group, which currently ranks in the bottom 28% out of approximately 250 industries. Because this industry is ranked in the bottom half of all Zacks Ranked Industries, we expect it to underperform the market over the next 3 to 6 months. Candidates in the bottom half of industry groups can often represent solid potential short candidates.

While individual stocks have the ability to outperform even when included in poor-performing industries, their industry association serves as a headwind for any potential rallies. Note how this industry has underperformed the market this year at nearly every turn:

Image Source: Zacks Investment Research

Weak Foundation: Falling Short on Earnings and Deteriorating Forecasts

Earnings misses have been a sore spot for DLA during the past year. The apparel designer has fallen short of estimates in two of the past four quarters. DLA most recently reported a fiscal Q4 loss last month of -$0.04/share, missing the $0.61 consensus estimate by -106.56%. Revenues of $115.5 million also missed estimates. Last year, the company reported earnings in the fourth quarter of $0.96/share. This is the type of negative trend that the bears like to see. Consistently missing estimates by a wide margin is a recipe for stock price underperformance.

Analysts are bearish on the stock and have been revising earnings estimates downward as of late. For the current quarter, estimates have been slashed -145.1% over the past 60 days. The Q1 Zacks Consensus EPS Estimate now stands at $-0.23/share, translating to a -145.1% earnings regression relative to the same quarter last year.

For the current fiscal year, analysts have also reduced their EPS estimate by -58.05% in the past 60 days. The 2023 Zacks Consensus EPS Estimate is now $1.72/share, reflecting a -38.57% decline compared to last year.

Image Source: Zacks Investment Research

Technical Outlook

As illustrated below, DLA is in a sustained downtrend. Notice how the stock has plunged below both the 50-day and 200-day moving averages signaled by the blue and red lines, respectively. The stock is making a series of lower lows, with no respite from the selling in sight. Also note how both moving averages have rolled over and are sloping down – another good sign for the bears.

Image Source: StockCharts

While not the most accurate indicator, DLA has also experienced what is known as a ‘death cross’, wherein the stock’s 50-day moving average crosses below its 200-day moving average. DLA would have to make a serious move to the upside and show increasing earnings estimate revisions to warrant taking any long positions in the stock. The stock has fallen nearly 60% this year alone.

Final Thoughts

A deteriorating fundamental and technical backdrop show that this stock is a laggard. The fact that DLA is included in one of the worst-performing industry groups is simply another headwind in a long list of concerns. A history of earnings misses and falling future earnings estimates will likely serve as a ceiling to any potential rallies, nurturing the stock’s downtrend.

DLA’s characteristics have resulted in a Zacks Growth Style Score of ‘C’, indicating its prospects are dwindling. Potential investors may want to give this stock the cold shoulder, or perhaps include it as part of a short or hedge strategy. Bulls will want to steer clear until the situation shows major signs of improvement.